texas estate tax limits

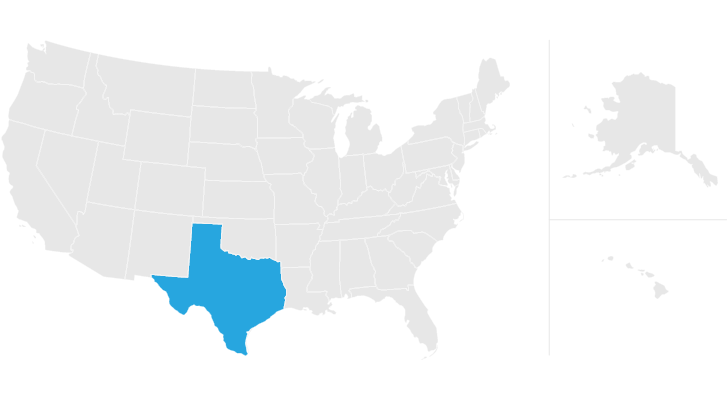

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and. Texas taxes real estate at a rate of 5 of the appraised value.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Limits.

. Texas estate tax system is. The growth rate excludes taxes levied on new construction and can be averaged over three years allowing taxing units to exceed the 35 threshold in some of them. Each are due by the tax day of the year following the individuals death.

Currently California only allows up to a 2 increase based on the value of the property. Market value is the price at which a property would. Theres no estate tax in Texas either although estates valued at more than 1206 million in 2022 and 1292 million in 2023 can be taxed at the federal level.

Meanwhile in Texas property appraisals have reached 10. The estate tax in the united states is a federal tax on the transfer of the estate of a person who dies. The current amount is 1206 million.

Tax Rate other than retail or wholesale 075. Property tax brings in the most money of all taxes available. Texas legislators have tried numerous ways to limit property tax growth.

There is a 40 percent federal tax however on estates over. The Estate Tax is a tax on your right to transfer property at your death. With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan.

Because both tax rates and property values fluctuate year to year property tax bills can be a scary unknown. Tax Rate retail or wholesale 0375. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

No Tax Due Threshold. Property tax in Texas is a locally assessed and locally administered tax. On Wednesday Texas Gov.

Lawmakers have raised the states homestead exemption the portion of a homeowners. As an example if your total tax rate is 25 and your home value is 100000 you will be liable for 1500 in. Texas Commercial Property Tax Increase Limits.

Greg Abbott pressed for property tax relief telling a big crowd in Fairview that he wants to take half of the projected 27 billion state surplus and use it. The current amount is 1206 million. Property Tax System Basics.

The Texas Legislature recently passed a bill that will increase the amount of money commercial property owners have to pay. In Texas the federal estate tax limits apply. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

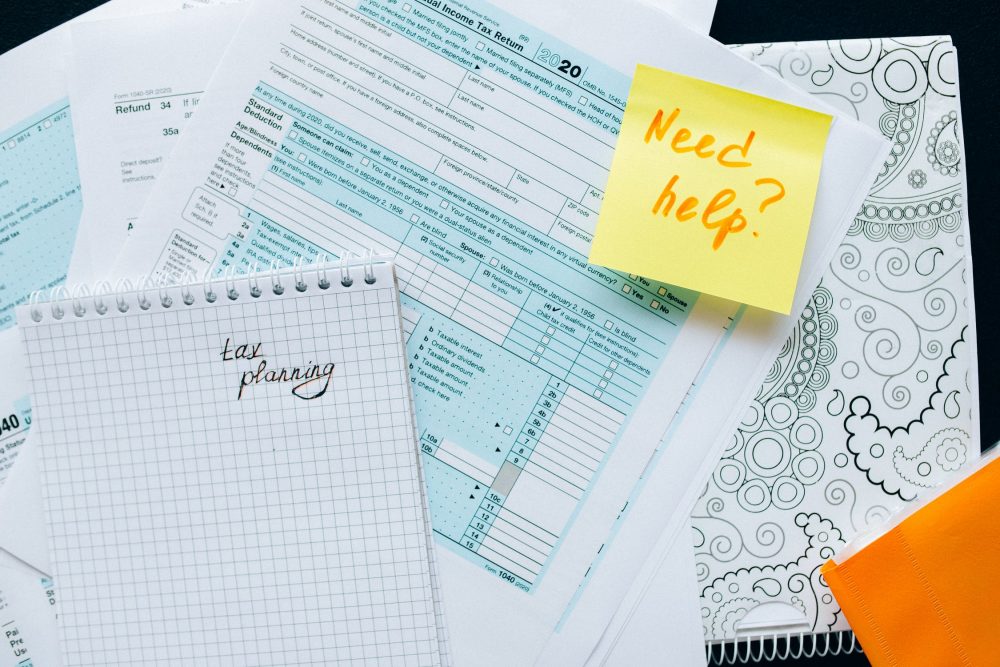

Fortunately in Texas if you have a homestead exemption in place your. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. There is no state property tax. In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married.

Estate Tax Rates Forms For 2022 State By State Table

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Massingill

The Ultimate Texas Estate Tax Guide Top 10 Strategies

Houston Chronicle Investigates Parsonages Tax Exemption Abuses Trinity Foundation

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Talking Taxes Estate Tax Texas Agriculture Law

House Democrats Plan Drops Repeal Of A Tax Provision For Inheritances

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Moved South But Still Taxed Up North

Avoid Probate In Texas With The Small Estate Affidavit Ryan Reiffert Pllc